freshwhitestudio.site

News

Best Real Estate Eft

Invests in stocks issued by real estate investment trusts (REITs), companies that purchase office buildings, hotels, and other real property. · Goal is to. Real Estate Funds ; %, % ; —. %, %. Top ETFs In The Real Estate Sector ; RWO. SPDR Dow Jones Global Real Estate ETF, ; DFAR. Dimensional US Real Estate ETF, ; FREL. ETF List: 61 ETFs ; VNQ, Vanguard Real Estate ETF, Vanguard ; XLRE, Real Estate Select Sector SPDR Fund, State Street Global Advisors ; SCHH, Schwab U.S. REIT ETF. ETFs investing in real estate ; REET · D · B USD, USD ; VNQI · D · B USD, USD ; · D · B USD, 1, JPY ; USRT · D · B USD, Best Fit Real Estate · #1. The Real Estate Select Sector SPDR® XLRE · #2. iShares Core US REIT ETF USRT · #3. Schwab US REIT ETF™ SCHH · #4. Invesco S&P ® Equal. The best REIT ETFs allow investors exposure to the real estate market. Vanguard Real Estate ETF (VNQ): $ billion in assets under management. Real estate investment trust (REIT) ETFs are exchange-traded funds (ETFs) that invest the majority of their assets in equity REIT securities and related. RWR. SPDR Dow Jones REIT ETF. + (+%) ; REK. ProShares Short Real Estate. (%) ; DRV. Direxion Daily MSCI Real Estate Bear 3X. Invests in stocks issued by real estate investment trusts (REITs), companies that purchase office buildings, hotels, and other real property. · Goal is to. Real Estate Funds ; %, % ; —. %, %. Top ETFs In The Real Estate Sector ; RWO. SPDR Dow Jones Global Real Estate ETF, ; DFAR. Dimensional US Real Estate ETF, ; FREL. ETF List: 61 ETFs ; VNQ, Vanguard Real Estate ETF, Vanguard ; XLRE, Real Estate Select Sector SPDR Fund, State Street Global Advisors ; SCHH, Schwab U.S. REIT ETF. ETFs investing in real estate ; REET · D · B USD, USD ; VNQI · D · B USD, USD ; · D · B USD, 1, JPY ; USRT · D · B USD, Best Fit Real Estate · #1. The Real Estate Select Sector SPDR® XLRE · #2. iShares Core US REIT ETF USRT · #3. Schwab US REIT ETF™ SCHH · #4. Invesco S&P ® Equal. The best REIT ETFs allow investors exposure to the real estate market. Vanguard Real Estate ETF (VNQ): $ billion in assets under management. Real estate investment trust (REIT) ETFs are exchange-traded funds (ETFs) that invest the majority of their assets in equity REIT securities and related. RWR. SPDR Dow Jones REIT ETF. + (+%) ; REK. ProShares Short Real Estate. (%) ; DRV. Direxion Daily MSCI Real Estate Bear 3X.

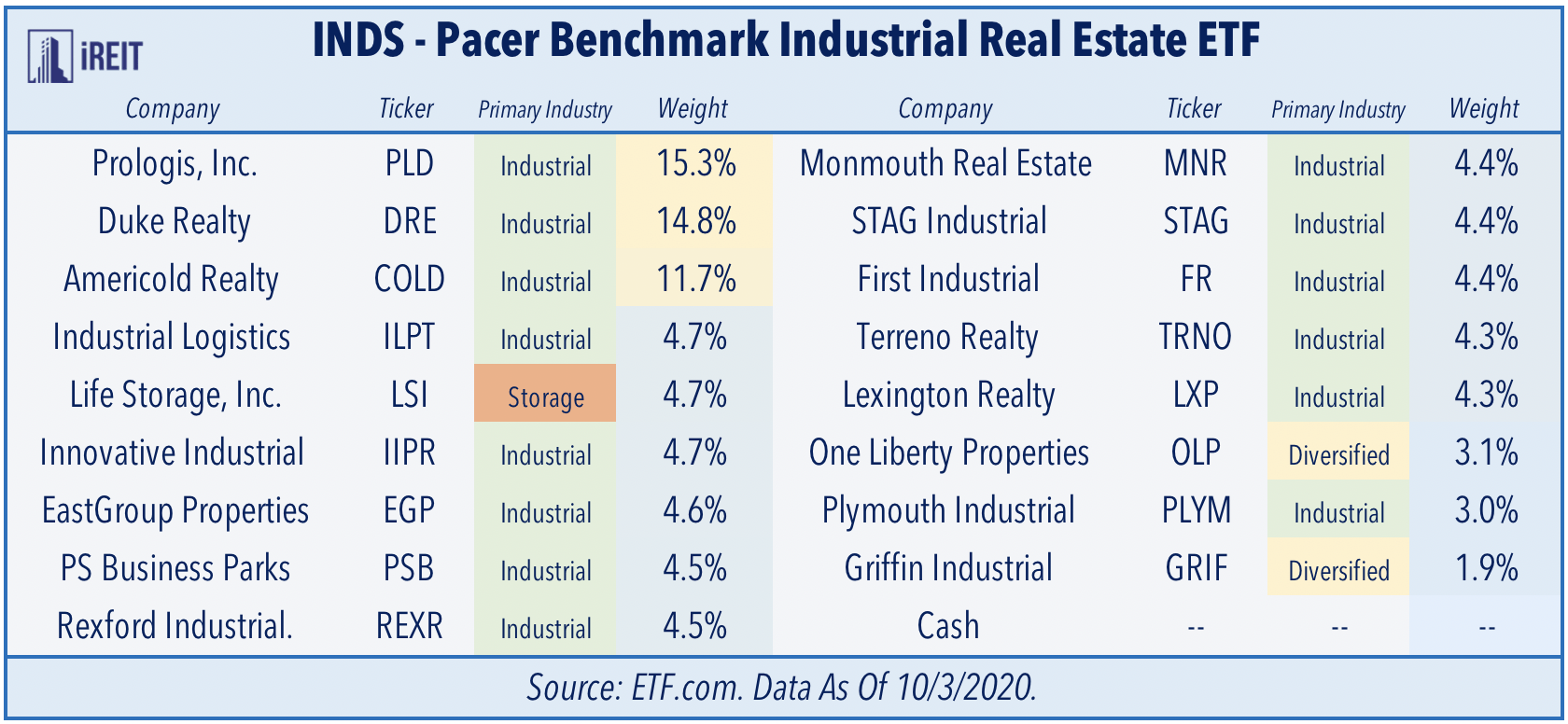

The Fund seeks to achieve high total return through growth of capital and current income by investing principally in equity real estate investment trusts . The iShares Residential and Multisector Real Estate ETF seeks to track the investment results of an index composed of US residential, healthcare and self-. 1. VRTPX · Vanguard Real Estate II Index Fund Institutional Plus Shares. % ; 2. PLD · Prologis Inc. % ; 3. AMT · American Tower REIT. %. These ETFs are designed to generate amplified returns through the use of financial instruments including swaps, futures, and other derivatives. What are the largest REIT ETFs? · Vanguard Real Estate ETF (VNQ): $ billion in assets under management, % in annual expenses, % yield · Schwab U.S. As of [freshwhitestudio.site_weekends]. A real estate investment trust (REIT) is a company that owns, operates or finances income-generating real estate across a range. These ETFs are designed to generate amplified returns through the use of financial instruments including swaps, futures, and other derivatives. Real Estate ETFs Might Not Lag Much Longer. Rob Isbitts | Jun 25, Can Vanguard Crack Europe's Top 3 ETF issuers? Jamie Gordon | Sep 13, Here are some of what we think might be the best property ETFs to watch for retail investors. These have been selected for recent market news. Among the best REIT ETFs, Vanguard Real Estate ETF (VNQ) and Schwab US REIT ETF (SCHH) offer attractive investment opportunities with diversified portfolios of. BLDG Cambria Global Real Estate ETF · Multi-factor approach to real-estate investing focused on value, quality and momentum · Competitive yield · Lower fee, daily. Top 10 Holdings ; REALTY INCOME CORP REIT USD, O · , US, REAL ESTATE ; SIMON PROPERTY GROUP INC REIT USD, SPG, , US Proprietary investment approach that incorporates both top-down macroeconomic analysis and bottom-up real estate analysis. Reliable Inflation Hedge. We. Top 50 Cash Cows Growth Leaders ETF. Read More · Resources · Product Pacer Industrial Real Estate ETF. A strategy-driven exchange traded fund (ETF). VNQ. Vanguard Real Estate ETF. + (+%) ; SCHH. Schwab U.S. REIT ETF. + (+%) ; XLRE. Real Estate Select Sector SPDR Fund. + Top 10 · 1. VENTAS INC REIT USD % · 2. AMERICAN TOWER CORP REIT USD % · 3. EQUINIX INC REIT USD % · 4. INVITATION HOMES INC REIT USD The Vert Global Sustainable Real Estate ETF is distributed by Quasar Distributors, LLC. Back To Top. Fidelity ETFs ; FQAL · FPRO · FSMD ; Fidelity Quality Factor ETF · Fidelity Real Estate Investment ETF · Fidelity Small-Mid Multifactor ETF ; +% · +% · +%. The iShares U.S. Real Estate ETF seeks to track the investment results of an index composed of U.S. equities in the real estate sector.

Can You Trade In One Car For Two Cars

The answer is generally yes. Most dealerships around the Canton and Hudson area are happy to get more cars to add to their pre-owned inventory. Property, such as a motor home, may be allowed as a trade-in in either classification. More than one trade-in is allowed, if the property fits the same generic. yes. You can trade in 1 car on 2, you can trade in 2 cars on 1, you can trade in a boat, a motorcycle, an RV. If you find that your car payments are unaffordable and you want to purchase a cheaper vehicle, having equity in your car makes a big difference. As long as. At least your trade-in worth will be reduced if your vehicle has a salvage title and some auto dealerships will not accept vehicles with a salvage title at all. In other words, the dealer can be a one-stop shop for finding a new car, securing a car loan, and trading in your old model, but you still need to ensure you're. Can you trade in two cars for one? Yes! Trading in two cars for one is often possible at most dealerships and can even come with plenty of benefits. In many cases, yes! Most dealerships are happy to trade two cars that you don't love for one car that you do. So, can you trade two cars for one? Yes! It's often possible to trade in multiple vehicles for one at most car dealerships. With that being said, can you. The answer is generally yes. Most dealerships around the Canton and Hudson area are happy to get more cars to add to their pre-owned inventory. Property, such as a motor home, may be allowed as a trade-in in either classification. More than one trade-in is allowed, if the property fits the same generic. yes. You can trade in 1 car on 2, you can trade in 2 cars on 1, you can trade in a boat, a motorcycle, an RV. If you find that your car payments are unaffordable and you want to purchase a cheaper vehicle, having equity in your car makes a big difference. As long as. At least your trade-in worth will be reduced if your vehicle has a salvage title and some auto dealerships will not accept vehicles with a salvage title at all. In other words, the dealer can be a one-stop shop for finding a new car, securing a car loan, and trading in your old model, but you still need to ensure you're. Can you trade in two cars for one? Yes! Trading in two cars for one is often possible at most dealerships and can even come with plenty of benefits. In many cases, yes! Most dealerships are happy to trade two cars that you don't love for one car that you do. So, can you trade two cars for one? Yes! It's often possible to trade in multiple vehicles for one at most car dealerships. With that being said, can you.

Can you trade two cars for one? Yes, trading in two vehicles for one shouldn't be a problem and it can help you to enjoy an even lower monthly car payment. But what if you have two vehicles that you want to trade-in? Can you trade in two cars for one? In general, the answer is yes. Dealerships are always looking to. The answer is yes! However, the loan on your current vehicle won't go away because you've traded it in; you'll still have to pay off the balance. We do not accept more than one trade-in vehicle toward the purchase of a new or used vehicle. Back to Top. The short answer is yes, it's generally possible to trade in two cars for one, but there are a few important factors to keep in mind. When a purchaser trades in a motor vehicle on the purchase of two or more motor vehicles from the same seller and the trade-in motor vehicle is greater in value. The answer is yes! However, the loan on your current vehicle won't go away because you've traded it in; you'll still have to pay off the balance. We usually get asked, "Can I trade in two cars for one?" and the answer is yes! You can trade in multiple vehicles at MINI of Warwick and sometimes it comes. You have positive equity when a trade-in vehicle is worth more than the remaining loan balance. A new vehicle will lose value when you drive it off the lot. By trading in your current vehicle, you can use its value towards your new vehicle purchase. This option is offered by most dealerships. If you are asking yourself, “Can I trade in two cars for one?” the simple answer is yes. It will depend on the value of your vehicles and how much you still owe. Only one vehicle can be applied as a trade-in to a new purchase, but if you have a second vehicle, we are more than happy to buy it outright. Generally speaking, the answer is yes. Dealerships can make a profit on just about any trade-in car, and most are more than willing to accept multiple trades. If you've been wondering if it's possible to trade in multiple vehicles for one new car, the answer is yes! While it's not a common situation, trading in. You can trade in two cars for one using the same process as if you were trading in a single vehicle. Our service team will assess the vehicles you have with a. Yes, you can actually trade in two cars for one. It's not common, but our Warwick finance team will negotiate with you if you want to trade in two cars for one. Some car dealers advertise that, when you trade in your car to buy another one, they'll pay off the balance of your loan. No matter how much you owe. 1. Discover how much negative equity you have · 2. Consider a less expensive vehicle · 3. Select the right financing period · 4. Estimate your financing · 5. Get. Yes! Whether you're downsizing or looking for a lower monthly car payment, you can trade in two cars for one at most dealerships. Learn more about trading. Sevierville shoppers looking to get the best deal possible are asking themselves, “Can you trade in two cars for a new car?” The answer to this question is.

Cars That Cost 25000

25, - 30, 30, - 35, 35, - 40, 40, Find Used Cars Under $25, Near Me. Update. Showing 1 - 25 out. Browse new vehicles for sale on freshwhitestudio.site, with prices under $ Shop new cars by price. New cars under $20, · New cars under $25, · New. New Cars for Sale Under $25, · Buick Envista Preferred · Kia Forte GT · Chevrolet Trax LT · Chevrolet Malibu LS · Chevrolet Trax LT. cars under $25, for sale or order in Australia ; Mazda CX-3 Akari DK Auto. $24, · 4cyl L Petrol ; Mitsubishi ASX LS XB Auto 2WD MY $17,*. Of course, you could also buy a cheaper-than-average new car, like a Honda Civic for $25, and not be considered wealthy. cars that are 3x the price of the. Nissan Cars. More Action. Combining power, style and performance, Nissan Price is Manufacturer's Suggested Retail Price (MSRP). MSRP excludes tax. Find the best used car under $ near you. Every used car for sale comes with a free CARFAX Report. We have used cars. New cars under $25, for sale or order in Australia ; Suzuki Swift GL Auto. $25, · $22, · Nundah Suzuki. Nundah Suzuki ; MG MG3 Excite Auto MY Shop used cars under $ for sale on Carvana. Browse used cars online & have your next vehicle delivered to your door with as soon as next day delivery. 25, - 30, 30, - 35, 35, - 40, 40, Find Used Cars Under $25, Near Me. Update. Showing 1 - 25 out. Browse new vehicles for sale on freshwhitestudio.site, with prices under $ Shop new cars by price. New cars under $20, · New cars under $25, · New. New Cars for Sale Under $25, · Buick Envista Preferred · Kia Forte GT · Chevrolet Trax LT · Chevrolet Malibu LS · Chevrolet Trax LT. cars under $25, for sale or order in Australia ; Mazda CX-3 Akari DK Auto. $24, · 4cyl L Petrol ; Mitsubishi ASX LS XB Auto 2WD MY $17,*. Of course, you could also buy a cheaper-than-average new car, like a Honda Civic for $25, and not be considered wealthy. cars that are 3x the price of the. Nissan Cars. More Action. Combining power, style and performance, Nissan Price is Manufacturer's Suggested Retail Price (MSRP). MSRP excludes tax. Find the best used car under $ near you. Every used car for sale comes with a free CARFAX Report. We have used cars. New cars under $25, for sale or order in Australia ; Suzuki Swift GL Auto. $25, · $22, · Nundah Suzuki. Nundah Suzuki ; MG MG3 Excite Auto MY Shop used cars under $ for sale on Carvana. Browse used cars online & have your next vehicle delivered to your door with as soon as next day delivery.

Ford Mustang® GT Premium Convertible in Race Red (extra-cost color option) shown as $55, 8. Mustang. Toyota, Honda, Mazda, Nissan, Kia, Hyundai, Subaru, Chevrolet, Ford, and Volkswagen all sell cars in the $20, to $30, price range. Read More. SUVs. Sedans. $25,, $30,, $35,, $40,, $45,, $50,, $55,, $60, CarsTrue Cost to OwnIncentivesEdmunds Forums. Best-rated cars by price. around. I'd like to find a vehicle from: Min price, $0, $5,, $10,, $15,, $20,, $25,, $30,, $35,, $40,, $45,, $50,, $55,, $60, Step into a Toyota and drive off with a deal! Our selection of new cars under $25, is designed to impress without the stress of a hefty price tag. Top 10 Cars Under 25 Lakh ; Maruti Invicto, Rs. Lakh ; Isuzu V-Cross, Rs. Lakh ; Mahindra Thar Roxx, Rs. Lakh ; Tata Curvv EV, Rs. Lakh. $25, Honda Civic Sport. Certified Used Honda Civic Sport Your insurance rate can also drop due to the lower cost of repair for older models. Whether you buy new or used, there's more to the cost of your vehicle than purchase price. The CAA Driving Costs Calculator will help you build a better. Pre-Owned Under $25, · Value Your Trade · Sell/Trade Show Sell/Trade. Sell cost of a brand-new vehicle. It's at that point that quality, used Regina. UK dealer supplied Petrol new cars under £, compare s of discount new vehicles, finance or outright purchase and pay after delivery. Nissan Versa - This is the least expensive car on this list. It starts at $14, and even a fully loaded Versa stays under $25, Nissan. Used Cars Under $25, for Sale - Vehicle Pricing Info · Chevrolet Malibu. LT Sedan · Price Drop. Mercedes-Benz CLS-Class. Used cars between $20, and $25, Virginia, Maryland and Washington DC Destination charge (varies by model) Leaf/Altima/Z $, Versa/Senta $ Price assumes that final purchase will be made in the State of CA, unless vehicle is non-transferable. Vehicle subject to prior sale. Applicable transfer fees. As the entry point in Buick's lineup, this compact SUV is designed to offer Buick levels of quality and comfort at a reasonable price. Starting under $25, View the entire line of Mercedes-Benz luxury sedans, coupes, SUVs, and sports cars organized by class and style. Discover our award-winning luxury vehicles. Prices represent the selling price minus current incentives and include air conditioning charge, freight, tire levy (where applicable), dealer-installed options. Results for cars under r in "cars under r" in Cars & Bakkies in South Africa in South Africa. Chana star i Single Cab Bakkie. R 25, Saved. Cheapest Cars · Nissan Versa · Mitsubishi Mirage G4 · Kia Forte · Hyundai Elantra · Nissan Sentra · Volkswagen Jetta · Toyota. These are vehicles that are completely free of charge. Free vehicles are It used to cost 25, CashCH2 in Chapter 1. This vehicle is retired and.

Spacs To Invest In

SPACs typically use the funds they've raised to acquire an existing, but privately held, company. They then merge with that target, which allows the target to. SPACs are shell companies, typically led by industry experts, that go public with the sole intention of acquiring a private company and listing it on an. The SPAC process is initiated by the sponsors. They invest risk capital in the form of nonrefundable payments to bankers, lawyers, and accountants to cover. SPACs are "blank check" companies. A sponsor forms a SPAC and raises money via a regular IPO. The intent is to use the money to buy another business. The. In this article, I'll break down the SPAC scam and explain why it's yet another sign of a bubble ripe for a correction. According to the U.S. Securities and Exchange Commission (SEC), SPACs are created specifically to pool funds to finance a future merger or acquisition. A SPAC—which can also be known as a "blank check company"—is a publicly listed company designed solely to acquire one or more privately held companies. The SPAC. Was talking to a colleague of mine and he was once fully on board buying up SPAC type stocks but after losing 80% of his investment he is. A SPAC raises capital through an initial public offering (IPO) for the purpose of acquiring an existing operating company. SPACs typically use the funds they've raised to acquire an existing, but privately held, company. They then merge with that target, which allows the target to. SPACs are shell companies, typically led by industry experts, that go public with the sole intention of acquiring a private company and listing it on an. The SPAC process is initiated by the sponsors. They invest risk capital in the form of nonrefundable payments to bankers, lawyers, and accountants to cover. SPACs are "blank check" companies. A sponsor forms a SPAC and raises money via a regular IPO. The intent is to use the money to buy another business. The. In this article, I'll break down the SPAC scam and explain why it's yet another sign of a bubble ripe for a correction. According to the U.S. Securities and Exchange Commission (SEC), SPACs are created specifically to pool funds to finance a future merger or acquisition. A SPAC—which can also be known as a "blank check company"—is a publicly listed company designed solely to acquire one or more privately held companies. The SPAC. Was talking to a colleague of mine and he was once fully on board buying up SPAC type stocks but after losing 80% of his investment he is. A SPAC raises capital through an initial public offering (IPO) for the purpose of acquiring an existing operating company.

How to invest in a SPAC after the merger. Once the SPAC merges with its target company, you can invest in the brand's ticker on the market. For example, blank-. How to invest in a SPAC after the merger. Once the SPAC merges with its target company, you can invest in the brand's ticker on the market. For example, blank-. A sophisticated financing tool deserves an equally sophisticated risk mitigation strategy. Our experts help place the right insurance policy for your SPAC. A SPAC is a company with no existing operations that is incorporated for the sole purpose of making one or more unspecified future acquisitions, typically. SPACs have two years to complete an acquisition or they must return funding to investors. Generally, SPACs can raise capital during the IPO of up to 20 times of the initial funds provided by the sponsor(s). If the (post-IPO) investment concept of a. A: Typically, SPAC stocks are priced at $10 a share with a warrant that allows you to buy more shares later. Q: Whats a SPAC warrant? A: A SPAC warrant gives. SPACs start by raising capital on a stock exchange, typically pricing their common stock at $10 and offering warrants to buy additional shares as a sweetener to. Stocks ; 35, IVCA, Investcorp India Acquisition Corp ; 36, SBXC, SilverBox Corp III ; 37, HCVI, Hennessy Capital Investment Corp. VI ; 38, SKGR, SK Growth. SPACs represent an alternative to the traditional IPO, offering a source of financing and an efficient route to going public that may be a better fit for. Around SPACs with $ billion in trust have deadlines to invest in the first half of , and the temptation is to throw a Hail Mary pass and hope to. Whether you are investing in a SPAC by participating in its IPO or by purchasing its securities on the open market following an IPO, you should carefully read. “SPAC” stands for special purpose acquisition company, and it is a type of blank check company. SPACs have become a popular vehicle for various transactions. SPACs—or Special Purpose Acquisition Companies—are publicly-traded investment vehicles that raise funds via an initial public offering (IPO) in order to. A Special Purpose Acquisition Company (SPAC), also known as a "blank check company," is a company with no commercial operations that is formed strictly to raise. SPACs as a Trading Strategy. Retail investors who seek to invest in the SPAC shares and treat them as a trading vehicle, should fully understand how the. Possibility of raising additional capital: SPAC sponsors will raise debt or PIPE (private investment in public equity) funding in addition to their original. SPACs are all over the news, but what is a SPAC and is it good for investors? Find out what makes a special purpose acquisition company. We find that although investments in SPACs are available to retail investors, such investments are minimal. investors would invest in SPACs, is extremely. Total SPAC investment nearly doubled from $83 billion in to over $ billion in , and it seems like they're in the headlines every day.

How Good Is Progressive At Paying Claims

Join the people who've already reviewed Progressive. Your experience can help others make better choices. Is Progressive good at paying claims? Progressive is generally thought of favorably when it comes to how they handle claims and they don't get as many. Easily able to pay my bill on line and the price was right compared to my past company. I was still able to get the same coverage at a much better price. Progressive does give good rates when switching but I have never had a good experience when renewing it. They give all kinds of reasons on why the insurance is. How Do Progressive's Auto Insurance Policies Compare to Other Companies' Policies? In our experience, Progressive writes smaller insurance policies than other. The Progressive Corporation is an American insurance company. In late , Progressive became the largest motor insurance carrier in the U.S. The company. Is Progressive good at paying claims? According to our research, Progressive policyholders seem to be mostly satisfied with the insurer's claims process. Is Progressive good at paying claims? Progressive's A+ Rating with AM Best demonstrates that the insurer has the money and financial strength to pay claims. Progressive might make it simple to purchase or change a car insurance policy, but they make it almost impossible to get paid for an injury claim! They only. Join the people who've already reviewed Progressive. Your experience can help others make better choices. Is Progressive good at paying claims? Progressive is generally thought of favorably when it comes to how they handle claims and they don't get as many. Easily able to pay my bill on line and the price was right compared to my past company. I was still able to get the same coverage at a much better price. Progressive does give good rates when switching but I have never had a good experience when renewing it. They give all kinds of reasons on why the insurance is. How Do Progressive's Auto Insurance Policies Compare to Other Companies' Policies? In our experience, Progressive writes smaller insurance policies than other. The Progressive Corporation is an American insurance company. In late , Progressive became the largest motor insurance carrier in the U.S. The company. Is Progressive good at paying claims? According to our research, Progressive policyholders seem to be mostly satisfied with the insurer's claims process. Is Progressive good at paying claims? Progressive's A+ Rating with AM Best demonstrates that the insurer has the money and financial strength to pay claims. Progressive might make it simple to purchase or change a car insurance policy, but they make it almost impossible to get paid for an injury claim! They only.

The statute of limitations for insurance claims varies by state, as well as by claim type. What can I do to avoid delays in receiving my claim settlement. Progressive Insurance is a massive insurance company, with revenues well over $1 billion each year. They do not manage this kind of income by paying out. Instead, Progressive auto insurance uses sophisticated software and technological tools to pay less benefits or no benefits to injury victims. Progressive has. Progressive is one of the top auto insurance providers in CA. They have very specific accident reporting policies for their policyholders, and may not be as. Progressive is decent at paying claims, compared to the average insurance company, scoring out of 1, for its claims process in J.D. Power's latest claims. The claims process can be complicated, and insurance companies often deny claims. good amount. I would highly recommend them to anyone who finds them. Their coverage is very good, and the customer service is actually polite, and decent. So anecdotally, I'd say yes, absolutely. But then here in. Firm claims to be the number one writer of auto insurance through independent agents. Good student discount – By adding a full-time student who. However, the insurer paying for the repair charges can argue the reasonableness of the estimate and bill. claims appropriately, Progressive does so as well. Overall, its competitive rates, handy add-on coverages like gap and rideshare insurance and various rewards and discounts make Progressive a pretty solid auto. Check out what questions other people are asking about their claim · Will you pay for a rental while my car is in the shop? · How is fault determined? · Who pays. In particular, Redditors complain about Homesite's poor claims handling and customer service. More generally, some users have noticed their Progressive home. Progressive is one of the top auto insurance providers in CA. They have very specific accident reporting policies for their policyholders, and may not be as. If the accident wasn't your fault, Progressive should pay you for the cost of your property damage. Because Texas is an at-fault state, you can file a claim. Progressive is a corporate giant, and they did not build that kind of success by paying full claim amounts. They limit payments whenever possible, and their. In fact, Consumer Reports rated Progressive's claims process (the satisfaction of going through a claim) for auto insurance as Very Good – which is a great mark. Progressive is estimated to insure over 11 million vehicles nationwide. As with other insurance companies, Progressive adjusters will attempt to settle a claim. Is Progressive a good insurance company? · Claims Satisfaction: Below average · Customer Satisfaction: Below average · Complaint Index: Average · Financial Strength. Progressive is estimated to insure over 11 million vehicles nationwide. As with other insurance companies, Progressive adjusters will attempt to settle a claim.

Best Online Savings Account Interest Rates

Here's a short list of good online banks with >5% APY. Just a great platform for finding and hooking up with great interest rates to grow my. Learn about the benefits of a Chase savings account online. Compare Chase savings accounts and select the one that best suits your needs. Best high-yield savings account rates of August ; Capital One. Performance Savings · % ; American Express National Bank (Member FDIC). High Yield. CIT Bank named Best Online Savings Account and Best High-Yield Savings Interest Rates for the Savings Connect Account are variable and may change. Put your money to work, open a high-interest savings account today with the best rates savings account that can help you grow your online savings. Put. A high yield savings account to help reach financial goals with a % Annual Percentage Yield & no minimum balance or service fees. Apply online today! The national average annual percentage yield for savings accounts is %. Top Savings Account Interest Rates. UFB Portfolio Savings logo. UFB Portfolio. I found Ally Bank's high-yield savings account quite reliable with competitive rates interest rates and ERs/fees can make a significant. Earn more with % APY63 (that's 15x the bank industry average!71). And with fewer fees, rest easy knowing your money will stay your money. Move. Here's a short list of good online banks with >5% APY. Just a great platform for finding and hooking up with great interest rates to grow my. Learn about the benefits of a Chase savings account online. Compare Chase savings accounts and select the one that best suits your needs. Best high-yield savings account rates of August ; Capital One. Performance Savings · % ; American Express National Bank (Member FDIC). High Yield. CIT Bank named Best Online Savings Account and Best High-Yield Savings Interest Rates for the Savings Connect Account are variable and may change. Put your money to work, open a high-interest savings account today with the best rates savings account that can help you grow your online savings. Put. A high yield savings account to help reach financial goals with a % Annual Percentage Yield & no minimum balance or service fees. Apply online today! The national average annual percentage yield for savings accounts is %. Top Savings Account Interest Rates. UFB Portfolio Savings logo. UFB Portfolio. I found Ally Bank's high-yield savings account quite reliable with competitive rates interest rates and ERs/fees can make a significant. Earn more with % APY63 (that's 15x the bank industry average!71). And with fewer fees, rest easy knowing your money will stay your money. Move.

Comparison chart ; Oaken Financial · Oaken Savings · % ; Outlook Financial · High Interest Savings · % ; Peoples Trust*** · e-Savings · % ; Saven. The national average annual percentage yield for savings accounts is %. Top Savings Account Interest Rates. UFB Portfolio Savings logo. UFB Portfolio. High Yield CD. Best for: Earning a higher interest rate when you lock in your funds for a longer term. Personal banking rates. When we say we have your best financial interest in mind, we mean it. Visit here any time to see what you could be earning. Savings. The most recent rates from the FDIC put the national savings APY average at %, while there are many high-yield savings accounts that offer a % APY or. %. APY · Member Share and Savings · Savings Account Features · Member Advantage Savings · Member Share Savings · Early Saver · How to Open an Account. Online savings accounts Higher savings rates are back You'll find some of the best savings rates out there - right here · % APY · % APY · % APY · Which. Tap the button to select banks ; % APY $ ; National Average % APY $92 ; Ally Bank % APY $ ; American Express % APY $ ; Chase % APY $4. SoFi High-Yield Checking and Savings Combo · Service Credit Union Military Savings Accounts · Bask Bank Mileage Savings Account · Discover Bank Online Savings. Vio Bank offers CDs, High Yield Savings and Money Market accounts with some of the best rates in the nation, allowing you to save smart and earn more. There is no minimum Direct Deposit amount required to qualify for the stated interest rate. SoFi members with direct deposit are eligible for other SoFi Plus. High-Interest Savings Accounts from Discover Bank, Member FDIC offer high yield interest rates with no monthly balance requirements or monthly fees. Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area. With the Western Alliance Bank High-Yield Savings Premier account, you can enjoy FDIC insurance and no fees3 while earning a much higher return on your money. Link your savings account to your personal checking account for Overdraft Protection with no overdraft transfer fees. You're all good. Track. No minimum balance requirement. Find and Open Online Savings Accounts Once again, the best savings account interest rates can vary and fluctuate based on. Maximize your savings with % APY on an FNBO Direct High-Yield Online Savings Account. Start Saving Today! If you want easy access to your money at a high interest rate, then a High Yield Saving Account could be a great fit for you. Here's what to expect when you. Interest rate with direct deposit: 4%; Minimum account balance: None. This online-only bank falls under Equitable Bank. With no physical locations, it doesn't. The Barclays Online Savings Account offers industry-high interest rates (APYs) and secure, 24/7 access to your funds. Open an account today.

How To Calculate Monthly Car Payment Formula

Principal Amount x Interest Rate x Time (in years) = Total Interest; Divide the total interest by the number of months in your loan term to find the monthly. Biweekly Payments for an Auto Loan Calculator. This calculator shows you possible savings by using an accelerated biweekly payment on your auto loan. By paying. Free auto loan calculator to determine the monthly payment and total cost of an auto loan, while accounting for sales tax, fees, trade-in value, and more. Car Loan Calculator. Use this calculator to help you determine your monthly car loan payment or your car purchase price. After you have entered your current. Figure the payment amount by entering the following formula, without the quotation marks, in cell E4: "=PMT(E2/12,E3,E1)." [4] X Trustworthy Source. A Car Payment Calculator that helps you determine your monthly payment and the time it would take you to pay off your debt. Our auto loan calculator will provide detailed cost estimates for any proposed car loan. Find the monthly payment, total cost, total interest and more! Free and easy-to-use automated calculator which quickly estimates your monthly car loan payments & helps you figure out how expensive of a car you can. Estimate your monthly payments with freshwhitestudio.site's car loan calculator and see how factors like loan term, down payment and interest rate affect payments. Principal Amount x Interest Rate x Time (in years) = Total Interest; Divide the total interest by the number of months in your loan term to find the monthly. Biweekly Payments for an Auto Loan Calculator. This calculator shows you possible savings by using an accelerated biweekly payment on your auto loan. By paying. Free auto loan calculator to determine the monthly payment and total cost of an auto loan, while accounting for sales tax, fees, trade-in value, and more. Car Loan Calculator. Use this calculator to help you determine your monthly car loan payment or your car purchase price. After you have entered your current. Figure the payment amount by entering the following formula, without the quotation marks, in cell E4: "=PMT(E2/12,E3,E1)." [4] X Trustworthy Source. A Car Payment Calculator that helps you determine your monthly payment and the time it would take you to pay off your debt. Our auto loan calculator will provide detailed cost estimates for any proposed car loan. Find the monthly payment, total cost, total interest and more! Free and easy-to-use automated calculator which quickly estimates your monthly car loan payments & helps you figure out how expensive of a car you can. Estimate your monthly payments with freshwhitestudio.site's car loan calculator and see how factors like loan term, down payment and interest rate affect payments.

Monthly payment and annual percentage rate (APR) will vary based on the term, amount financed, model year, loan-to-value (LTV) percentage, credit history and. How to Calculate Auto Loan Interest: First Payment Only · Divide your interest rate by the number of monthly payments per year. · Multiply the monthly payment by. Three Big Factors About Car Loans · Auto Loan Interest Rates · Simple Interest Costs · Amortization. Free Car Payment Calculator helps you to compute monthly payments and total interest paid. Change loan amount, period, APR, sale amount, down payment. It's total loan amount (including interest) divided by the loan term (number of months you have to repay the loan. For example, the total interest for a $30, Calculate the payment on your new Subaru. Get Guaranteed Trade-In value for pre-owned Subarus and access to Equifax credit scores & Black Book used car. Calculating Car Loan Interest · Total interest payment = Loan amount (outstanding balance) x (interest rate / number of payments per year) · Outstanding balance. Let's say you have your eye on a compact car or SUV. Choose the make and model you want, or alternatively enter the vehicle's price into the auto loan. To use this formula, divide your interest rate by the number of payments you make in a year (usually 12). Multiply this result by your principal to find out. This Auto Loan Calculator gives you a versatile tool to answer all those questions and more. It will not only calculate your monthly payments for you, based on. Estimate your monthly payments with freshwhitestudio.site's car loan calculator and see how factors like loan term, down payment and interest rate affect payments. Here is the APR formula: APR = ((Total Interest Paid + Fees) / Principal Amount Borrowed/ Number days in loan) x x Our auto loan payment calculator can help estimate the monthly car payments of your next vehicle. calculate car loan payments using complex formulas. Three Big Factors About Car Loans · Auto Loan Interest Rates · Simple Interest Costs · Amortization. Edmunds Lease Calculator will help you estimate your monthly car payment on a new car or truck lease. Use the "Fixed Payments" tab to calculate the time to pay off a loan with a fixed monthly payment. For more information about or to do calculations specifically. Estimate your monthly car payments on select BMW models using specific criteria and explore available financing and lease options. Use our car payment calculator to estimate your monthly payment Calculate Your Payment. Get a clearer picture of your estimated loan amount. Loan. Estimate your monthly car payment with our payment calculators. Ready to take the next step? Get pre-qualified with no impact to your credit score. Biweekly payments. Biweekly savings are achieved by simply paying half of your monthly auto loan payment every two weeks and making times your monthly auto.

1 2 3 4 5